LG Electronics IPO vs Tata Capital IPO: A Complete Look at GMP, Pricing, and Key Details Before Subscriptions Open

LG Electronics IPO

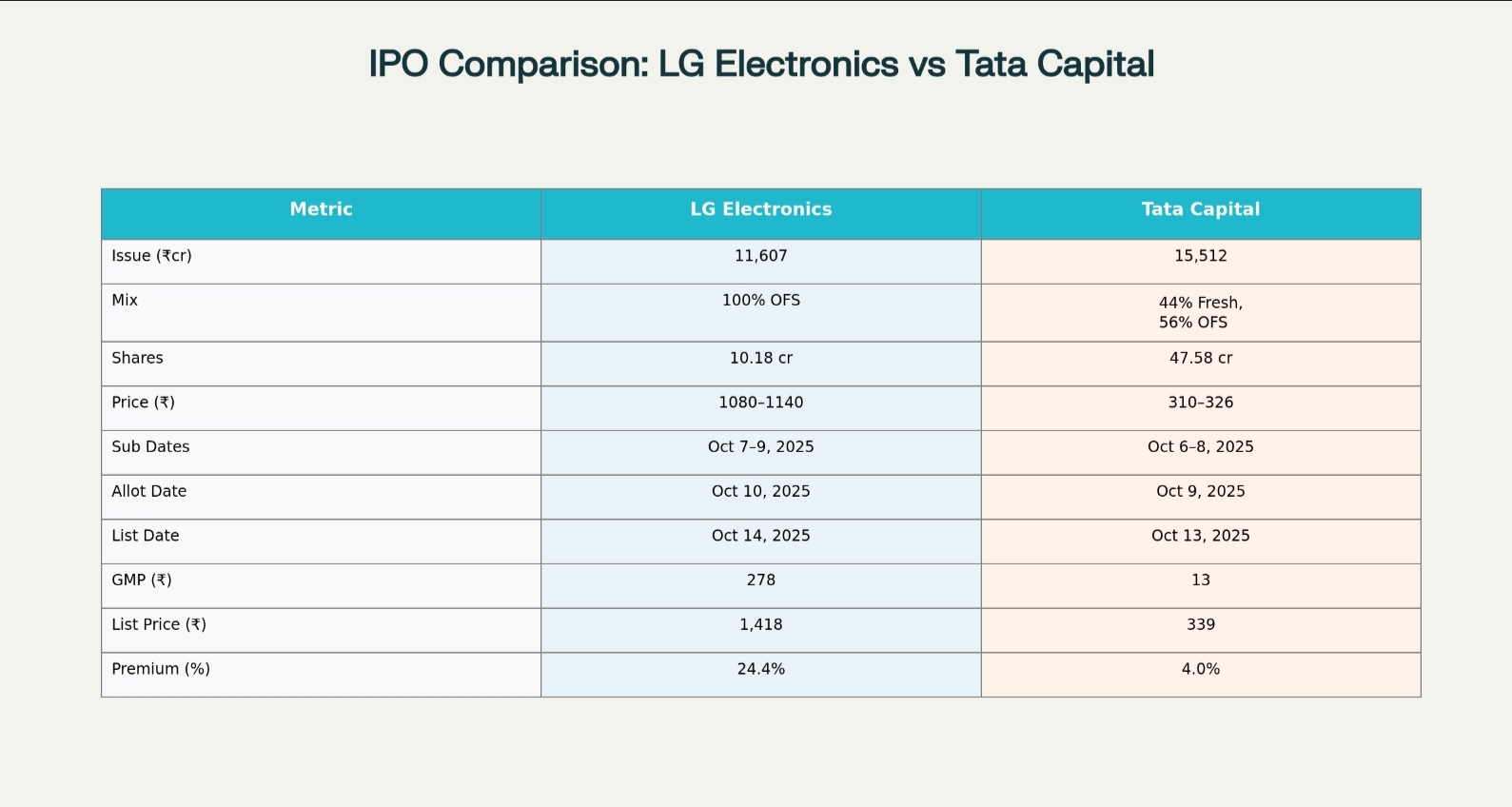

LG Electronics offer its IPO with an issue size of ₹11,607.01 crore, fully structured as an Offer for Sale of 10.18 crore shares. This means the company won’t receive any fresh capital from the issue—the proceeds will go to existing shareholders who existing investments.

The IPO will open for subscription on October 7, 2025, and close on October 9, 2025. The price band has been fixed at ₹1,080–₹1,140 per share. As of October 6, Grey market premium (GMP) for this IPO is around ₹278, indicate listing near ₹1,418—an estimated 25% premium over the upper price.

For investors seeking short-term listing gains, LG Electronics IPO appears attractive. However, experts caution that since this is a pure OFS, it won’t inject new funds into the company’s balance sheet, which could limit its long-term growth rate.

Tata Capital IPO

By comparison, the Tata Capital IPO offer worth ₹15,511.87 crore, comprising a fresh issue of ₹6,846 crore and an offer for sale of ₹8,665.87 crore. The subscription period start on October 6 to October 8, 2025, with allotment expected on October 9 . IPO listing scheduled for October 13 on both the BSE and NSE.

The price band of this IPO has been set at ₹310–₹326 per share. Unlike LG Electronics, Tata Capital’s IPO includes a significant fresh issue component, ensuring that the funds raised strengthen of balance sheet, expand lending operations.

As of October 6, Grey market premium (GMP) of this IPO is around ₹13, indicate listing near ₹338—an estimated 4% premium over the upper price.

Brokerages have expressed largely positive sentiment. According to Canara Bank Securities, “Tata Capital is well-positioned in India’s expanding NBFC sector, with strong growth potential in retail and SME lending supported by digital innovation. Its diversified portfolio, the trust of the Tata brand, prudent liability management, superior asset quality, and AI-enabled phygital model underpin sustainable long-term growth. The IPO is valued at 4x FY25 P/B, aligning with industry peers. Any integration effects from Tata Motors Finance are expected to stabilize soon, backed by AAA ratings and a solid funding profile.”

Given its fundamentals and growth outlook, the brokerage has recommended subscribing for the long term.

Disclaimer-

The information shared on this blog is only for educational and informational purposes. This should not be considered as financial or trading advice. Investors must therefore exercise due caution while investing or trading in stocks. India Knowledge Hub website or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.